By Dennis Walsh, Senior Consultant & Director of Social Media

Last week, I attended the NIRI Annual Conference. It was very educational and an incredible opportunity to meet and exchange ideas with many of the approximately 1,300 investor relations professionals from more than 20 countries that attended the event in Seattle.

NIRI organized more than 45 informative panel sessions and workshops that were led by some of IR’s top influencers. While I wanted to attend each one, unfortunately I am not omnipresent. For those that I did attend, I left with several key takeaways that can benefit any IR program and wanted to share those with you here at The Podium.

Read More

Investor Presentation,

IR Program Planning,

Board Packages,

Shareholder Surveillance,

Disclosure,

Targeting,

Board Communications,

Annual Meeting,

Corporate Governance,

Shareholder Activism,

SEC,

Proxy Season,

Board of Directors,

Proxy Access,

NIRI,

Disclosure Policy,

IRO,

CFO,

Social Media,

Investor Relations,

Activist Investors

By Jim Buckley

At the recently concluded NIRI National conference in Seattle, I was invited to moderate a panel entitled Communicating the Deal: How IR Can Drive Success. The session featured a seasoned cast of practitioners who have successfully navigated an assortment of M&A transactions ranging from strategic purchases and spinoffs to hostile takeovers and going private. Participants were treated to valuable insights, anecdotes and lessons learned from Andrew Kramer of Interactive Data Corporation, Brian McPeak of Owens Corning, John Chevalier of Procter & Gamble and Kristy Nicholas of Expedia.

Deals have begun to pick up momentum again in recent years, with the Institute of Mergers, Acquisitions and Alliances (a fabulous site if you need M&A data) estimating that there were approximately 15,000 deals in North America during 2011 amounting to $1.6 trillion. This is the equivalent of someone buying Apple, Exxon Mobil, Microsoft, Wal-Mart and General Electric – combined. Worldwide, that number rises to $5.1 trillion.

Read More

Mergers & Acquisitions,

Crisis Communications,

NIRI,

Speaking Engagements,

Investor Relations,

Activist Investors,

Acquisitions

By Dennis Walsh, Senior Consultant & Director of Social Media

Let’s face it; you can’t ignore social media any longer…even as part of your investor relations strategy. You were hoping Facebook would go the way of MySpace and Friendster, but it keeps on growing and has even made its way into our world with its initial public offering.

Talk of Twitter used to elicit laughter in the board room. Now, competitors are using it to promote their brand; hedge funds are using it to decide when to make trades; and rumors spread like wildfires over the Twittersphere. Twitter companion site StockTwits has evolved as a popular platform for traders to share investment ideas. Add to that: YouTube, Flickr, SlideShare, LinkedIn, oh my! IR pros certainly put up a good fight, but it’s time to embrace social media…it’s here to stay.

Feeling a little overwhelmed? We’d like to help you with that.

Read More

IR Program Planning,

Investor Relations Blog,

Reg FD,

Strategic Messaging,

Sharon Merrill Associates,

Investor Relations Agency,

IR Website,

IPO,

Social Media,

Small-cap IR,

Investor Relations,

Socialize IR,

Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

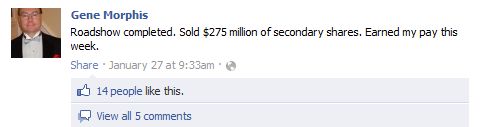

On Monday, Houston-based Francesca's Holdings Corporation (NASDAQ: FRAN) announced that it had fired its chief financial officer, Gene Morphis, after discovering he had “improperly communicated Company information through social media.” This case highlights how important it is for all companies to have a clear social media policy in place and to educate top executives on their roles and responsibilities as company spokespeople.

Mr. Morphis was very active on Twitter, publishes a personal blog, and has public profiles on LinkedIn and Facebook. Mr. Morphis spoke freely about his duties as CFO of Francesca’s in his Facebook status updates, which were open for public viewing. In one example he states that he just completed a roadshow for a secondary offering, which appears to have been announced via press release prior to the post.

Read More

IR Program Planning,

Disclosure,

Reg FD,

Sharon Merrill Associates,

Investor Relations Agency,

Disclosure Policy,

Social Media Policy,

IRO,

Social Media,

Investor Relations,

Socialize IR,

Investor Relations Firm

By Jim Buckley

To kick off the New Year, we decided to renew an old Sharon Merrill tradition and take a lighthearted look at what’s in and what’s out in investor relations and related areas in 2012. Hope you enjoy, and have a happy and successful 2012.

Read More

Hedge Fund,

Board Communications,

Annual Meeting,

Investor Relations Agency,

Proxy Access,

Crisis Communications,

Social Media,

Investor Relations,

Activist Investors

By Dennis Walsh, Senior Consultant & Director of Social Media

As another year comes to a close, two things are probably on every IRO’s mind: New Year’s resolutions and next year’s investor relations plan. Every year, one of the most common resolutions is to get fit. People spend a tremendous amount of time and money developing new health and fitness plans to achieve that goal. This year, apply the same techniques to your IR plan in order to have a successful 2012.

Establish Achievable Goals

You may not be ready to compete in the Arnold Classic body building competition next year, but fitting into that new bathing suit by summer is certainly a realistic goal. When developing your 2012 IR plan, set equally realistic expectations. For example, expecting to grow your capitalization from a mid-cap to a large-cap in just a few months is likely an unrealistic benchmark. Instead, focus on more achievable metrics, such as meeting with a greater number of investors, attending more conferences, or increasing trading volume. Meeting these goals will support your ultimate goal of maximizing shareholder value.

Read More

Holiday,

IR Program Planning,

Board Packages,

Investor Relations Blog,

Board Communications,

Annual Meeting,

Sharon Merrill Associates,

Investor Relations Agency,

Investor Meetings,

NIRI,

Investor Conference,

IRO,

IR Budgets,

IPO,

Shareholder Communications,

Social Media,

Small-cap IR,

Investor Relations,

Investor Relations Firm

5 Useful Tips for Reading Body Language in a Business Environment

By Dennis Walsh, Senior Consultant & Director of Social Media at Sharon Merrill

In business, people aren’t always completely honest. I know…stop the presses! As investor relations professionals, we are constantly playing a poker game with Wall Street. So how do you know if someone is not being completely truthful with you? Read their body language.

Nonverbal communication, or body language, often sends a different message from the spoken word. The way a person shakes hands, gestures while talking, or even crosses their legs, sends subtle but clear signals about the real meaning behind the message. Even a simple touch of the nose may indicate that a person is being untruthful.

Many Wall Street firms have hired body language experts to train analysts and portfolio managers to identify the nonverbal cues that executives give. So it’s beneficial for CEOs and CFOs to recognize these signals, to ensure they aren’t unwittingly conveying the wrong message.

Read More

Investor Presentation,

Interviews,

Investor Day,

Investor Meetings,

Presentation Training,

NIRI,

Media Relations,

Shareholder Communications,

Roadshow Planning,

Investor Relations

By Dennis Walsh, Senior Consultant & Director of Social Media

It’s that time of the year again. Four times a year, institutional investors that hold more than $100 million in assets under management are required to file a Form 13F with the SEC that lists the securities held in their portfolio and the number of shares owned…45 days prior. Every quarter when I’m going through these filings for my clients, I have a similar reaction as Adam Sandler in “The Wedding Singer”:

Things that could have been brought to my attention YESTERDAY

The 13F filings provide a snapshot into the makeup of a company’s shareholder base at the end of each quarter. While they offer some insight into how a company’s ownership has been trending, they fail to provide who the shareholders are in real time. It is extremely frustrating when the markets are under pressure and volatility is high – as it has been in recent weeks – to not know who owns your company’s stock. During the recent rollercoaster swings in the market at the beginning of August, the publicly available shareholder data was current only as of March 31 (ownership data as of June 30 wasn’t due to the SEC until August 15)! With all the buying and selling that has taken place, a company’s shareholder base could potentially be wildly different since the end of the previous quarter.

Read More

IR Program Planning,

Shareholder Surveillance,

Targeting,

Investor Meetings,

SEC,

Buy-Side,

NIRI,

Shareholder Communications,

Roadshow Planning,

Small-cap IR,

Investor Relations

By Dennis Walsh, Senior Consultant & Director of Social Media

In many of the StreetScope® perception audits we conduct, we often inquire about what makes a successful investor relations program. Is the Street satisfied with the level of outreach? Is there something specifically a firm can do to enhance its communications? Being the investor relations enthusiast that I am, I’m always hoping to discover an innovative idea that we have yet to implement.

However, more often than not, the responses are all pretty simple. Wall Street wants access to management. They want informative answers to their questions. Many even want an investor day that describes the company’s long-term growth strategy. So old-fashioned (I jest)! What about having an active Twitter/StockTwits account (follow me) or Facebook page, a cool management video or an interactive annual report?

Read More

IR Program Planning,

Corporate Access,

IR Website,

IRO,

Shareholder Communications,

Social Media,

Investor Relations

By Jim Buckley

I recently led a workshop session at the NIRI National conference entitled Time to Invest in Your Company’s Investor Day. The workshop featured a deep dive on all the fundamental components and strategic aspects of an Investor Day, or Analyst Day as some people still prefer. The session was very comprehensive and included a panel with three of today’s best and brightest IROs. (Ok, full disclosure, I handpicked Alexia, Jennifer and Jerry.)

We collectively shared our Investor Day wisdom and experiences, including the Good, the Bad and the Ineffective. The response to the panel, particularly in some follow-up discussions, was decidedly positive. Given that a few folks have asked me recently for supplemental materials – which are available to conference attendees here – I thought I would share some of the key takeaways, as well as appending the “Investor Day Do’s and Don’ts” handout that was developed for the session.

Read More

Reg FD,

Investor Day,

NIRI,

Analyst Day,

Perception Audit,

Investor Relations