A sell-side analyst at a leading global bank recently said to me that “investors are shell-shocked by the market decline.” Major indexes, such as the NASDAQ 100 Technology Sector or the Dow Jones U.S. Technology Index, are down 30% or more since the beginning of the year. Wall Street is being flipped on its head by supply shortages, the war in Ukraine, a tight labor market, and soaring prices. Following the pandemic boom and growth stock hype, long-term tech darlings, such as Amazon, Google, Meta and Netflix, are suddenly falling out of favor. Frustrated investors don’t know where to turn – creating a unique opportunity for you to convince them to invest in your company. Here are five tips to help investors recognize the value of your technology business.

Articulate your business model & strategies

The tech sector is the largest single segment of the market and a fiercely competitive space – yet companies have shockingly similar business models and strategies. Does adding new customers, growing with existing customers, or moving into new markets sound familiar? It will to your investors. That’s why it is your job to articulate what differentiates your model. Half the battle is understanding how your competitors operate and constructing an elegant business model and strategy that create reinforcing business cycles. The other half is explaining your business model and strategies to investors while providing compelling proof points that demonstrate execution.

Simplify your story

2021 was quite the year for IPOs and SPACs. During this period, more than 1,000 companies went public in the US, setting an all-time record. These newly public companies, as well as thousands of other listed companies, are competing for a limited number of investors. And, as a result, those investors have limited time to focus on just you. So, whether you are an established or newly public company, you need to simplify your story. Imagine, you are the investor. You are planning to attend a conference and meet with 10 different companies for 30 minutes each. To stand out, management will need to provide a brief, easy-to-understand business overview, they will need to create excitement for their story, and they will need to include memorable facts and statements. The simpler, the better. Oftentimes, using analogies is an effective way to take the complex and make it more relatable to a general audience.

Get your metrics right

Investors will scrutinize your financials and perform in-depth analyses to make investment decisions. It’s your job to control your narrative by emphasizing the metrics that are most relevant to your business and correlate to your success. Allowing analysts and investors to focus on the wrong metrics will most likely result in misaligned expectations, disappointment and unfair valuations. It’s important to remember that once you commit to disclosing a set of metrics, investors will expect regular updates in these same areas. A sudden change in disclosure signals a negative development – leading investors to jump to conclusions and expect the worst. By identifying, tracking, and consistently communicating the right metrics, you can help investors better understand and evaluate your business.

Demonstrate your commitment to innovation

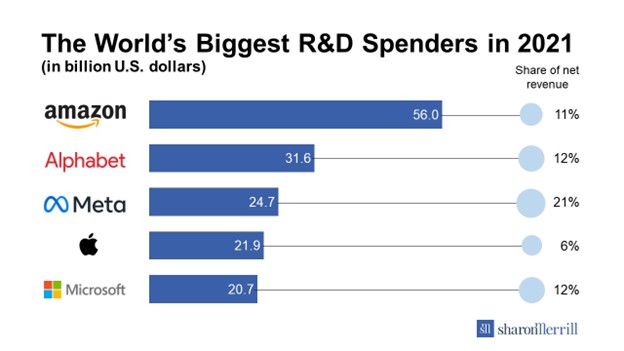

For the vast majority of tech companies, the R&D line on the P&L is a critical indicator of future growth potential.

R&D is a key component of the innovation process that drives a steady stream of growth opportunities, such as new features, solutions, products and processes, and allows you to enhance your competitive advantages. With this in mind, It comes as no surprise, that the companies spending the most on R&D in 2021 are well-known tech giants, including Amazon, Alphabet, and Meta. When speaking about R&D, it’s critical to highlight the purpose of your R&D spend and how it informs and shapes your strategy, equity story, and future growth opportunities. By communicating your aspirations and goals, you help investors see the big picture, demonstrate strategic management, and position your company as innovative and forward-thinking.

Build trust and credibility

Until the beginning of 2022, investors excitedly invested in tech and the promise of market share gains and future earnings – only to hurriedly pull out of risky investments in the following months because the macro environment had changed and the tech sector had fallen out of favor. To retain investors in trying market times, it is key to invest in long-term relationships and build trust and credibility through honest communication, consistent engagement and persistent execution. If investors have a good relationship with you and believe in your story and future opportunities, they are less likely to sell your stock at the first sign of trouble. Great first steps in building long-term trust and credibility with investors include proactive and consistent communications to inform them about the latest updates, accommodating meeting requests to answer questions, and taking the time to explain your story.

Conclusion

Since the initial days of Silicon Valley and the rise of the modern-day computing industry, tech companies have gone through many changes – and their investors with them. Today, reporting strong growth rates and communicating only the bare minimum is not enough to convince investors to buy your stock. To take on risk, investors need information and proof points from you. Clearly position your company and differentiate yourself from your competitors. Communicate your strategy, business model, and correlated metrics to prove why and how you will succeed. And articulate your future growth opportunities while demonstrating your commitment to innovation. Communicating consistently in this way will enable you to build long-lasting relationships and trust with investors and will help them recognize the value of your business.

Are you getting credit for the full value of your technology business? Does the investment community often struggle to understand your strategy and unique value proposition? With more than three decades of experience, Sharon Merrill can help you plan and deliver a best-in-class investor relations program. Click here for an overview of our investor relations service offerings or fill out the form below for a complimentary consultation.