By David Calusdian, Executive Vice President & Partner

*Originally appeared on Samuel's CFO Blog. Samuel Dergel is Director and Search Consultant at Stanton Chase International. Mr. Dergel specializes in Executive Search for Chief Financial Officers.

As the new CFO of a publicly held company, somewhere on your extensive “to do” list is implementing an effective investor relations program. Whether or not the IR function was a well-oiled machine when you arrived, or virtually non-existent, there are key areas you need to address immediately to ensure that you are effectively taking the IR reins. So here are six steps for success as you accept responsibility for the IR function.

1) Understand your shareholder base. Research the investment styles of your shareholders to determine why they may have bought shares– and what might cause them to sell. See what type of investor concentration you have in your shareholder base. Identifying whether your shareholders are weighted toward a growth, value or income investment style, for example, can offer insight as to what they are expecting the company to achieve near or long term. Also investigate whether there are known “activist” firms among your shareholders, and what catalysts usually cause them to initiate a proxy fight. Make it a priority to speak with your shareholders by phone as soon as possible, and then meet them in person within your first few quarters as CFO. Also consider an investor perception audit to understand the sentiments of your shareholder base -- and identify any misperceptions about the company -- to most effectively build your IR program.

Read More

Disclosure,

Reg FD,

Board Communications,

Conference Calls,

Investor Relations Agency,

Investor Meetings,

Guidance,

Disclosure Policy,

Shareholder Communications,

Earnings Call,

Social Media,

Investor Relations,

Earnings,

Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

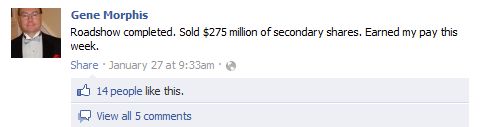

On Monday, Houston-based Francesca's Holdings Corporation (NASDAQ: FRAN) announced that it had fired its chief financial officer, Gene Morphis, after discovering he had “improperly communicated Company information through social media.” This case highlights how important it is for all companies to have a clear social media policy in place and to educate top executives on their roles and responsibilities as company spokespeople.

Mr. Morphis was very active on Twitter, publishes a personal blog, and has public profiles on LinkedIn and Facebook. Mr. Morphis spoke freely about his duties as CFO of Francesca’s in his Facebook status updates, which were open for public viewing. In one example he states that he just completed a roadshow for a secondary offering, which appears to have been announced via press release prior to the post.

Read More

IR Program Planning,

Disclosure,

Reg FD,

Sharon Merrill Associates,

Investor Relations Agency,

Disclosure Policy,

Social Media Policy,

IRO,

Social Media,

Investor Relations,

Socialize IR,

Investor Relations Firm

By Maureen Wolff, President and Partner

Companies planning to go public need to be able to hit the ground running on the day of the IPO pricing with an investor relations program. In order to prepare, Sharon Merrill President and Partner Maureen Wolff provides tips on what to do before and after the S-1 filing in the videos below.

Read More

Investor Presentation,

IR Program Planning,

Disclosure,

Strategic Messaging,

Investor Relations Agency,

Investor Meetings,

IR Website,

Guidance,

Board Structure,

Disclosure Policy,

IPO,

Investor Relations,

Earnings,

Investor Relations Firm

“But social media for investor relations won’t work for my company!”

The use of social media is radically changing the way our society communicates – and the investment community is no exception. But many investor relations officers still refuse to use social media as an IR tool. I’ve heard any number of reasons why “social media for IR won’t work for my company.” Our business model is primarily B2B. The retail shareholder base is small. Our market cap is less than $500 million. My corporate counsel tends to be conservative regarding disclosure. Notwithstanding the huge volume of research that supports the use of social media in IR, I think it would be easier to land a lunch with Warren Buffett than to convince the typical IRO to set up a Twitter account.

I recently spent a whirlwind of a week focused on social media in investor relations. The NIRI Westchester Connecticut chapter invited me to serve on a panel discussion entitled, “Investor Relations and Twitter – To Do or Not to Do?” with Darrell Heaps, president & CEO at Q4 Websystems (@darrellheaps), Dan Dykens, co-president at Meet the Street (@meetthestreet), and Doug Chia, senior counsel & assistant corporate secretary at Johnson & Johnson (@dougchia). I was pleased to see that more than half the room had at least been on Twitter. Two questions seemed to preoccupy the audience: “what should we know about using Twitter,” and “how can we use it as part of an effective IR strategy?”

Read More

Disclosure,

Strategic Messaging,

IR Website,

Crisis Communications,

NIRI,

Disclosure Policy,

Twitter,

IRO,

Media Relations,

Speaking Engagements,

Shareholder Communications,

Social Media,

Investor Relations,

Monitoring,

Investor Relations Firm

Sell-side research has undergone profound structural changes during the past decade with far-reaching implications affecting the quality of the research and how research is generated, sold and compensated. Decimalization, Regulation FD, unbundling of trading from research and the hedge fund “brain drain” have all negatively impacted sell-side profitability, product quality and small cap coverage in today’s age of diminished sell-side research.

Decimalization. When the SEC required exchanges to narrow their bid-ask spreads from one-sixteenth, or $0.0625, to $0.01 per share effective in 2001, the profitability of trading floors collapsed amidst tremendous spread compression. While working on the sell-side, I recall hearing many times over, “when we get a trade we can all hear the cash register ring.” After decimalization, I never heard this again. Sell-side boutiques, historically adequately compensated for their research with large bid-ask spreads, now struggled to stay afloat. They reduced staff levels and often swapped higher-priced, seasoned analysts for less-experienced and less-costly researchers.

Read More

Hedge Fund,

Disclosure,

Reg FD,

Sell-side Research,

Targeting,

Investor Meetings,

Sell-side Coverage,

Disclosure Policy,

Shareholder Communications,

Investor Relations,

Earnings

On January 4th, the first business day of the new decade, Dow Jones VentureSource released figures suggesting that 2010 will be a stronger year for IPOs. They reported that eight companies completed public offerings in 2009, raising $904 million. This was a 64% increase from the $551 million generated through seven IPOs in 2008.

Looking ahead, VentureSource pointed to the 25 venture-backed companies that are currently in IPO registration as a sign that the market will improve as this year unfolds. The larger attendance and stronger sense of optimism at the most recent Deloitte Tech-Venture IPO Bootcamp, where I spoke on IPO investor relations, suggests the same thing.

So if the proverbial IPO window does open wider in 2010, a good number of venture-backed companies probably will jump through. This will send them into the hectic time of pre-IPO preparations.

Like skilled gymnasts or freestyle skiers, some of these companies will stick the landing. They’ll see good liquidity and strong underlying demand when their shares begin trading. Others will lose a few style points and generate only a tepid response from investors. For the underperformers, the leap into the public markets will conclude with a painful face plant.

Read More

Disclosure,

Strategic Messaging,

Presentation Training,

IR Website,

Guidance,

IPO,

Shareholder Communications,

Investor Relations