By Dennis Walsh, Senior Consultant & Director of Social Media

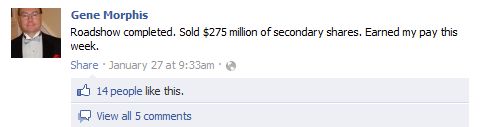

On Monday, Houston-based Francesca's Holdings Corporation (NASDAQ: FRAN) announced that it had fired its chief financial officer, Gene Morphis, after discovering he had “improperly communicated Company information through social media.” This case highlights how important it is for all companies to have a clear social media policy in place and to educate top executives on their roles and responsibilities as company spokespeople.

Mr. Morphis was very active on Twitter, publishes a personal blog, and has public profiles on LinkedIn and Facebook. Mr. Morphis spoke freely about his duties as CFO of Francesca’s in his Facebook status updates, which were open for public viewing. In one example he states that he just completed a roadshow for a secondary offering, which appears to have been announced via press release prior to the post.

Read More

IR Program Planning,

Disclosure,

Reg FD,

Sharon Merrill Associates,

Investor Relations Agency,

Disclosure Policy,

Social Media Policy,

IRO,

Social Media,

Investor Relations,

Socialize IR,

Investor Relations Firm

Sometimes the difference between success and failure when delivering a presentation is not the presentation slides at all. The problem most often is the presenter’s delivery. In the video below, Sharon Merrill Executive Vice President & Partner David Calusdian provides tips on how to get the most out of your presentation delivery.

Read More

Investor Presentation,

IR Program Planning,

Investor Relations Agency,

Presentation Training,

Media Relations,

IPO,

Investor Relations,

Investor Relations Firm

By David Calusdian, Executive Vice President & Partner

We’ve all seen bad investor presentations at various conferences. But what makes them bad? The purpose of an investor presentation is to convey the company’s investment thesis. If the presentation does not succeed in articulating the investment thesis in a memorable way, it has failed. So how do we ensure good presentation slides — and success? In the video below, Executive Vice President & Partner David Calusdian offers up some advice.

Read More

Investor Presentation,

IR Program Planning,

Strategic Messaging,

Investor Relations Agency,

Investor Meetings,

Presentation Training,

Shareholder Communications,

Investor Relations,

Investor Relations Firm

By Maureen Wolff, President and Partner

Companies planning to go public need to be able to hit the ground running on the day of the IPO pricing with an investor relations program. In order to prepare, Sharon Merrill President and Partner Maureen Wolff provides tips on what to do before and after the S-1 filing in the videos below.

Read More

Investor Presentation,

IR Program Planning,

Disclosure,

Strategic Messaging,

Investor Relations Agency,

Investor Meetings,

IR Website,

Guidance,

Board Structure,

Disclosure Policy,

IPO,

Investor Relations,

Earnings,

Investor Relations Firm

By Jim Buckley

To kick off the New Year, we decided to renew an old Sharon Merrill tradition and take a lighthearted look at what’s in and what’s out in investor relations and related areas in 2012. Hope you enjoy, and have a happy and successful 2012.

Read More

Hedge Fund,

Board Communications,

Annual Meeting,

Investor Relations Agency,

Proxy Access,

Crisis Communications,

Social Media,

Investor Relations,

Activist Investors

By Dennis Walsh, Senior Consultant & Director of Social Media

As another year comes to a close, two things are probably on every IRO’s mind: New Year’s resolutions and next year’s investor relations plan. Every year, one of the most common resolutions is to get fit. People spend a tremendous amount of time and money developing new health and fitness plans to achieve that goal. This year, apply the same techniques to your IR plan in order to have a successful 2012.

Establish Achievable Goals

You may not be ready to compete in the Arnold Classic body building competition next year, but fitting into that new bathing suit by summer is certainly a realistic goal. When developing your 2012 IR plan, set equally realistic expectations. For example, expecting to grow your capitalization from a mid-cap to a large-cap in just a few months is likely an unrealistic benchmark. Instead, focus on more achievable metrics, such as meeting with a greater number of investors, attending more conferences, or increasing trading volume. Meeting these goals will support your ultimate goal of maximizing shareholder value.

Read More

Holiday,

IR Program Planning,

Board Packages,

Investor Relations Blog,

Board Communications,

Annual Meeting,

Sharon Merrill Associates,

Investor Relations Agency,

Investor Meetings,

NIRI,

Investor Conference,

IRO,

IR Budgets,

IPO,

Shareholder Communications,

Social Media,

Small-cap IR,

Investor Relations,

Investor Relations Firm

By David Calusdian, Executive Vice President & Partner

*Originally appeared on OpenView Labs, the strategic and operational consulting arm of OpenView Venture Partners, a global Venture Capital fund that invests in expansion stage technology companies.

“In preparing for battle, I have always

found that plans are useless, but

planning is indispensable.”

- Dwight David Eisenhower

President Eisenhower could well have uttered the same quote about Crisis Communications. Developing a crisis communications plan is more about planning to mobilize for a potential crisis, than it is about writing step-by-step actions for specific pre-ordained scenarios. And this is what causes so many management teams to be confused about exactly what the components of a good crisis communication plan actually are. Here are five “Crisis Plan Essentials” to consider in order to get your team ready to communicate in a crisis.

1) Identify the Crisis Team

It’s important that the right people from the appropriate functional areas of the organization are ready to respond at a moment’s notice to a crisis and understand their responsibilities as members of the team. Along with the CEO and CFO, the team should include key people from public relations, corporate communications, investor relations, human resources, public affairs, sales and marketing. Make sure that at least two members of the crisis team have been media trained. A major crisis is no time to get your feet wet in media relations.

Read More

IR Program Planning,

Strategic Messaging,

Crisis Communications,

Shareholder Communications,

Investor Relations,

Activist Investors

By Maureen Wolff, President and Partner

Nothing has more power to change a boardroom’s dynamics than the election of dissident directors – especially when they arrive as a twosome. I had the honor of moderating a panel discussion on shareholder activism at the National Association of Corporate Directors New England Chapter breakfast event earlier this month, where seasoned board members talked about the lessons they’ve learned in battling high-profile proxy contests over the years.

One of the stories, told by a former board chairman, involved the legendary corporate raider Carl Icahn. A manufacturing glitch had resulted in a steep drop in his company’s share price. After repeated attempts, Icahn was finally successful in having two of his nominees elected to the board. This occurred not long after the principal of another activist institution had been elected as a director, and not long before the company received an unsolicited tender offer at a substantial premium to the then-current share price.

The former chairman painstakingly recreated the scenarios that unfolded over the next few months as the board considered the takeover offer. At first, he focused on the gulf in interests and motivations between the newly elected “directors” and long-time members of the board. Unlike the established directors, who had long been personally committed to the company’s vision, mission and business strategy, the dissidents’ only interest was in immediately monetizing the company’s value for shareholders, he said. Predictably, these conflicting goals led to tremendous stress and friction on the board.

Read More

Shareholder Meeting,

Shareholder Activism,

Proxy Season,

Proxy Access,

Crisis Communications,

Board Structure,

Shareholder Communications,

Investor Relations,

Activist Investors

5 Useful Tips for Reading Body Language in a Business Environment

By Dennis Walsh, Senior Consultant & Director of Social Media at Sharon Merrill

In business, people aren’t always completely honest. I know…stop the presses! As investor relations professionals, we are constantly playing a poker game with Wall Street. So how do you know if someone is not being completely truthful with you? Read their body language.

Nonverbal communication, or body language, often sends a different message from the spoken word. The way a person shakes hands, gestures while talking, or even crosses their legs, sends subtle but clear signals about the real meaning behind the message. Even a simple touch of the nose may indicate that a person is being untruthful.

Many Wall Street firms have hired body language experts to train analysts and portfolio managers to identify the nonverbal cues that executives give. So it’s beneficial for CEOs and CFOs to recognize these signals, to ensure they aren’t unwittingly conveying the wrong message.

Read More

Investor Presentation,

Interviews,

Investor Day,

Investor Meetings,

Presentation Training,

NIRI,

Media Relations,

Shareholder Communications,

Roadshow Planning,

Investor Relations

A Halloween Lesson with Apologies to Charles M. Schulz

By David Calusdian, Executive Vice President & Partner

Year in and year out, Linus sits in the neighborhood pumpkin patch trying to impress Charlie Brown’s little sister Sally with a personal introduction to The Great Pumpkin. She forgoes trick or treating to wait for the Great Pumpkin as he “flies through the air and brings toys to all the children of the world.” But every year, The Great Pumpkin disappoints, and as Linus puts it, there’s “nothing compared to the fury of a woman who has been cheated out of tricks or treats.” Now there’s a holiday icon in desperate need of reputation management. Here are three tips to reestablishing a positive personal brand whether you are a fictional cartoon character, disgraced athlete or corporate executive.

1) Determine Your Desired Brand Identity

Before you begin the reputation rebuilding process, decide what you want the essence of your new personal brand to be. Philanthropist? Industry expert? Respected business Leader? After you’ve determined your desired personal brand, develop a strategy to take action and then communicate to your key audiences. For example, in the years after Jimmy Carter’s failed presidential re-election bid, he re-branded himself as a humanitarian very successfully through his work with Habitat for Humanity. As for The Great Pumpkin, I’d recommend taking the same approach as Santa Claus and the Easter Bunny and finally make good on his toy delivering promise.

Read More

Strategic Messaging,

Presentation Training,

Reputation Management,

Crisis Communications,

Media Relations,

Shareholder Communications,

Investor Relations