By Dennis Walsh, Senior Consultant & Director of Social Media

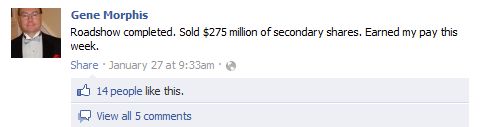

On Monday, Houston-based Francesca's Holdings Corporation (NASDAQ: FRAN) announced that it had fired its chief financial officer, Gene Morphis, after discovering he had “improperly communicated Company information through social media.” This case highlights how important it is for all companies to have a clear social media policy in place and to educate top executives on their roles and responsibilities as company spokespeople.

Mr. Morphis was very active on Twitter, publishes a personal blog, and has public profiles on LinkedIn and Facebook. Mr. Morphis spoke freely about his duties as CFO of Francesca’s in his Facebook status updates, which were open for public viewing. In one example he states that he just completed a roadshow for a secondary offering, which appears to have been announced via press release prior to the post.

Read More

IR Program Planning,

Disclosure,

Reg FD,

Sharon Merrill Associates,

Investor Relations Agency,

Disclosure Policy,

Social Media Policy,

IRO,

Social Media,

Investor Relations,

Socialize IR,

Investor Relations Firm

Sometimes the difference between success and failure when delivering a presentation is not the presentation slides at all. The problem most often is the presenter’s delivery. In the video below, Sharon Merrill Executive Vice President & Partner David Calusdian provides tips on how to get the most out of your presentation delivery.

Read More

Investor Presentation,

IR Program Planning,

Investor Relations Agency,

Presentation Training,

Media Relations,

IPO,

Investor Relations,

Investor Relations Firm

By David Calusdian, Executive Vice President & Partner

We’ve all seen bad investor presentations at various conferences. But what makes them bad? The purpose of an investor presentation is to convey the company’s investment thesis. If the presentation does not succeed in articulating the investment thesis in a memorable way, it has failed. So how do we ensure good presentation slides — and success? In the video below, Executive Vice President & Partner David Calusdian offers up some advice.

Read More

Investor Presentation,

IR Program Planning,

Strategic Messaging,

Investor Relations Agency,

Investor Meetings,

Presentation Training,

Shareholder Communications,

Investor Relations,

Investor Relations Firm

By Maureen Wolff, President and Partner

Companies planning to go public need to be able to hit the ground running on the day of the IPO pricing with an investor relations program. In order to prepare, Sharon Merrill President and Partner Maureen Wolff provides tips on what to do before and after the S-1 filing in the videos below.

Read More

Investor Presentation,

IR Program Planning,

Disclosure,

Strategic Messaging,

Investor Relations Agency,

Investor Meetings,

IR Website,

Guidance,

Board Structure,

Disclosure Policy,

IPO,

Investor Relations,

Earnings,

Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

As another year comes to a close, two things are probably on every IRO’s mind: New Year’s resolutions and next year’s investor relations plan. Every year, one of the most common resolutions is to get fit. People spend a tremendous amount of time and money developing new health and fitness plans to achieve that goal. This year, apply the same techniques to your IR plan in order to have a successful 2012.

Establish Achievable Goals

You may not be ready to compete in the Arnold Classic body building competition next year, but fitting into that new bathing suit by summer is certainly a realistic goal. When developing your 2012 IR plan, set equally realistic expectations. For example, expecting to grow your capitalization from a mid-cap to a large-cap in just a few months is likely an unrealistic benchmark. Instead, focus on more achievable metrics, such as meeting with a greater number of investors, attending more conferences, or increasing trading volume. Meeting these goals will support your ultimate goal of maximizing shareholder value.

Read More

Holiday,

IR Program Planning,

Board Packages,

Investor Relations Blog,

Board Communications,

Annual Meeting,

Sharon Merrill Associates,

Investor Relations Agency,

Investor Meetings,

NIRI,

Investor Conference,

IRO,

IR Budgets,

IPO,

Shareholder Communications,

Social Media,

Small-cap IR,

Investor Relations,

Investor Relations Firm

There is a popular cable network TV show called Bridezillas that often depicts women planning their wedding day as high-strung, unreasonable and at times displaying jaw-dropping outrageous behavior. Of course, this makes for great reality TV, but at times I find myself sympathizing with these women. After all, it will be the biggest day of their lives – it had better go as planned!

Similarly, the quarterly earnings call is one of the biggest days in the career of investor relations professionals and their companies. A seamless call is an IRO’s opportunity to shine. A call riddled with issues will damage his or her credibility. These calls require weeks of careful planning to ensure that the right messages are communicated effectively to shareholders. However, much like the bridezillas have to rely on other people to design a dress, coordinate the flower arrangements, bake the cake, etc., IROs must work with a variety of outside providers for the services necessary to facilitate an earnings call. With so much riding on the line, there is no shame in taking on the IRO-zilla role and demanding, rather, clearly stating needs and expectations. The IRO’s professional reputation is at stake.

Read More

IR Vendors,

IR Program Planning,

Investor Relations Agency,

IR Website,

NIRI,

IRO,

IR Budgets,

Earnings Call,

Social Media,

Investor Relations,

Earnings,

Investor Relations Firm

Hello again. We took a bit of a hiatus from blogging this summer, but we are now back to share a Halloween story sure to scare you straight!

Unless you are one of the 33 Chilean miners that were trapped underground for the past two months, you have likely been watching the drama unfold on Capitol Hill as the Business Roundtable and the U.S. Chamber of Commerce challenged the legality of the SEC’s new proxy access rule 14a-11, which allows qualifying shareholders to nominate directors for election at shareholder meetings and requires the corporation to include those nominees in the standard proxy statement. The petitioners claim that the new rules are subjective and violate federal and state law and the United States Constitution, and that the SEC did not assess the effect of the rules on efficiency, competition and capital formation. As a result, implementation of the rule has been delayed pending a resolution of the Court of Appeals. So the new proxy access rules will most likely not be implemented until the 2012 proxy season, at the earliest. Upon hearing this news, public corporations across the nation let out a collective sigh of relief.

Read More

Shareholder Meeting,

Board Communications,

Strategic Messaging,

Annual Meeting,

Shareholder Activism,

Investor Relations Agency,

Proxy Season,

Proxy Access,

Crisis Communications,

Board Structure,

Shareholder Communications,

Investor Relations,

Investor Relations Firm,

Activist Investors

Yesterday afternoon I presented a workshop entitled, “Giving Life to Your Investor Relations Presentation. . . and Your CEO” at the National Investor Relations Institute’s Annual Conference. We’ve all seen bad investor relations presentations. But what makes them bad? The purpose of an investor presentation is to convey the company’s “story,” which is essentially its investment thesis. If the presentation does not succeed in articulating the investment thesis in a memorable way, it has failed.

So how do we ensure good presentation slides -- and success? Here are a few tips:

Read More

Investor Presentation,

Investor Relations Agency,

Presentation Training,

NIRI,

Shareholder Communications,

Investor Relations,

Investor Relations Firm

On Monday evening, the Sharon Merrill Associates team attended the 2010 Bell Ringer Awards, sponsored by The Publicity Club of New England. The Bell Ringer Awards recognize and honor excellence and achievement in the communications and public relations professions. The awards are often hailed as the “Oscars” of PR/IR in New England and the club’s board always organizes a high-quality event. We are proud to announce that Sharon Merrill Associates was presented two prestigious awards, one for its Investor Relations Program and another for this blog, The Podium.

Read More

Bell Ringer Awards,

IR Program Planning,

Investor Relations Blog,

Sharon Merrill Associates,

Investor Relations Agency,

Investor Relations,

Investor Relations Firm

“But social media for investor relations won’t work for my company!”

The use of social media is radically changing the way our society communicates – and the investment community is no exception. But many investor relations officers still refuse to use social media as an IR tool. I’ve heard any number of reasons why “social media for IR won’t work for my company.” Our business model is primarily B2B. The retail shareholder base is small. Our market cap is less than $500 million. My corporate counsel tends to be conservative regarding disclosure. Notwithstanding the huge volume of research that supports the use of social media in IR, I think it would be easier to land a lunch with Warren Buffett than to convince the typical IRO to set up a Twitter account.

I recently spent a whirlwind of a week focused on social media in investor relations. The NIRI Westchester Connecticut chapter invited me to serve on a panel discussion entitled, “Investor Relations and Twitter – To Do or Not to Do?” with Darrell Heaps, president & CEO at Q4 Websystems (@darrellheaps), Dan Dykens, co-president at Meet the Street (@meetthestreet), and Doug Chia, senior counsel & assistant corporate secretary at Johnson & Johnson (@dougchia). I was pleased to see that more than half the room had at least been on Twitter. Two questions seemed to preoccupy the audience: “what should we know about using Twitter,” and “how can we use it as part of an effective IR strategy?”

Read More

Disclosure,

Strategic Messaging,

IR Website,

Crisis Communications,

NIRI,

Disclosure Policy,

Twitter,

IRO,

Media Relations,

Speaking Engagements,

Shareholder Communications,

Social Media,

Investor Relations,

Monitoring,

Investor Relations Firm