By Dennis Walsh, Vice President & Director of Social Media

The SEC finally has provided guidance on the use of social media for investor relations. The guidance came in a report on its investigation to determine whether Netflix CEO Reed Hasting had violated Reg FD. In a Facebook status update on his personal account, Hastings said Netflix had streamed 1 billion hours of content in June 2012, calling into question whether the post was selective disclosure of material information.

In its report, the SEC clarified that companies can use social media outlets like Facebook and Twitter to announce key information in compliance with Reg FD. It’s the moment we’ve all been waiting for, but with some key caveats.

Read More

IR Program Planning,

Reg FD,

Investor Relations Agency,

SEC,

IR Website,

Disclosure Policy,

Shareholder Communications,

Earnings Call,

Social Media,

Small-cap IR,

Investor Relations,

Socialize IR,

Earnings,

Investor Relations Firm

By David Calusdian, Executive Vice President & Partner

I recently participated as the designated “social media expert” as part of a crisis communications case study session at the 2012 NIRI Southwest regional conference. This year’s conference was held in New Orleans and the session centered on a fictitious publicly held bead manufacturing company (apropos for the conference host city) that found itself suddenly facing a major environmental crisis. During the true-to-life exercise, attendees took on the roles of the company’s corporate communications officers and were tasked with implementing all aspects of the crisis response plan.

In their new roles, the attendees had to make a number of decisions relating to the immediate actions of the fictitious company, “Beignet Beads & Baubles.” For example, should the company proceed with a press conference with the governor announcing a state grant that afternoon? Should management go forward with a scheduled presentation at a major investor conference in New York the next day? Should a planned announcement of a major plant expansion be delayed? As typically happens with a real crisis, the Beignet Beads & Baubles “crisis team-for-a-day” was given an increasing amount of information to complicate their decision-making process.

Read More

IR Program Planning,

Reg FD,

Strategic Messaging,

IR Website,

Crisis Communications,

Disclosure Policy,

Media Relations,

Shareholder Communications,

Social Media,

Investor Relations,

Monitoring,

Socialize IR,

Activist Investors

By Dennis Walsh, Senior Consultant & Director of Social Media

It’s that time of year again: Back to School! For my first job out of college I worked as an educator. This year, for “Back to School” season, I thought I’d step back into my teaching shoes. The following is a quick lesson on social media for investor relations for the marketing and public relations professional.

Technology is constantly changing the way we engage with our audience, so professional communicators must never stop learning new techniques. As a seasoned marketing or public relations professional, you’ve likely got social media covered. But how fluent are you in investor relations best practices? If you work for a public company, you might want to rethink your social media engagement strategy.

Read More

IR Program Planning,

Reg FD,

Crisis Communications,

Public Relations,

Disclosure Policy,

IRO,

Shareholder Communications,

Social Media,

Investor Relations,

Socialize IR,

Earnings,

Investor Relations Firm

By Jim Buckley

One of the investor relations issues that companies often struggle with is the “quiet period.” Here I’m not talking about the SEC mandated quiet period related to IPOs, other public offerings or around the release of lock-up agreements. Those all have defined legal parameters and lines drawn around what companies can and can’t do. I’m referring to the quarterly quiet period – where individual companies determine if, when and how they want to stop talking to the investment community as they approach the end of the quarter.

The quarterly quiet period is one of those gray areas that investor relations is famous for, and there is certainly no one-size-fits-all approach for companies. The fundamental principle behind the quarterly quiet period (or QQP) is straightforward. At some point around quarter end, management has knowledge of the company’s quarterly performance. So investors start calling in the last two weeks of every quarter and asking “How are things going?” They want to get a read on upcoming results through tone and demeanor. As a result, over time, companies began to institute a quiet period with the Street to avoid taking these calls. Makes sense, right? But how does each company handle its QQP? That’s where things start to get a little fuzzy.

Read More

IR Program Planning,

Disclosure,

Reg FD,

Conference Calls,

Investor Meetings,

SEC,

Guidance,

Disclosure Policy,

IRO,

Earnings Call,

Investor Relations,

Earnings

By Dennis Walsh, Senior Consultant & Director of Social Media

Last week, I attended the NIRI Annual Conference. It was very educational and an incredible opportunity to meet and exchange ideas with many of the approximately 1,300 investor relations professionals from more than 20 countries that attended the event in Seattle.

NIRI organized more than 45 informative panel sessions and workshops that were led by some of IR’s top influencers. While I wanted to attend each one, unfortunately I am not omnipresent. For those that I did attend, I left with several key takeaways that can benefit any IR program and wanted to share those with you here at The Podium.

Read More

Investor Presentation,

IR Program Planning,

Board Packages,

Shareholder Surveillance,

Disclosure,

Targeting,

Board Communications,

Annual Meeting,

Corporate Governance,

Shareholder Activism,

SEC,

Proxy Season,

Board of Directors,

Proxy Access,

NIRI,

Disclosure Policy,

IRO,

CFO,

Social Media,

Investor Relations,

Activist Investors

Sharon Merrill Associates on Monday captured The Publicity Club of New England’s coveted 2012 Platinum Super Bell at its annual Bell Ringer Awards, which annually recognizes the region’s most successful communications and public relations campaigns. We won the Platinum Super Bell for our investor relations program for Gibraltar Industries, recognizing us as “best in show” among the “Gold” winners in each of the 20 communications campaign categories. In addition, the agency also received a Gold Bell Ringer Award for best Investor/Financial Relations Campaign.

Read More

IR Program Planning,

Strategic Messaging,

Sharon Merrill Associates,

Investor Relations Agency,

Investor Relations

By Dennis Walsh, Senior Consultant & Director of Social Media

Let’s face it; you can’t ignore social media any longer…even as part of your investor relations strategy. You were hoping Facebook would go the way of MySpace and Friendster, but it keeps on growing and has even made its way into our world with its initial public offering.

Talk of Twitter used to elicit laughter in the board room. Now, competitors are using it to promote their brand; hedge funds are using it to decide when to make trades; and rumors spread like wildfires over the Twittersphere. Twitter companion site StockTwits has evolved as a popular platform for traders to share investment ideas. Add to that: YouTube, Flickr, SlideShare, LinkedIn, oh my! IR pros certainly put up a good fight, but it’s time to embrace social media…it’s here to stay.

Feeling a little overwhelmed? We’d like to help you with that.

Read More

IR Program Planning,

Investor Relations Blog,

Reg FD,

Strategic Messaging,

Sharon Merrill Associates,

Investor Relations Agency,

IR Website,

IPO,

Social Media,

Small-cap IR,

Investor Relations,

Socialize IR,

Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

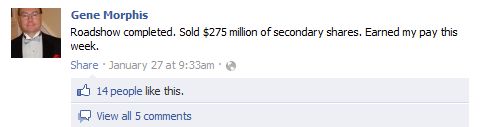

On Monday, Houston-based Francesca's Holdings Corporation (NASDAQ: FRAN) announced that it had fired its chief financial officer, Gene Morphis, after discovering he had “improperly communicated Company information through social media.” This case highlights how important it is for all companies to have a clear social media policy in place and to educate top executives on their roles and responsibilities as company spokespeople.

Mr. Morphis was very active on Twitter, publishes a personal blog, and has public profiles on LinkedIn and Facebook. Mr. Morphis spoke freely about his duties as CFO of Francesca’s in his Facebook status updates, which were open for public viewing. In one example he states that he just completed a roadshow for a secondary offering, which appears to have been announced via press release prior to the post.

Read More

IR Program Planning,

Disclosure,

Reg FD,

Sharon Merrill Associates,

Investor Relations Agency,

Disclosure Policy,

Social Media Policy,

IRO,

Social Media,

Investor Relations,

Socialize IR,

Investor Relations Firm

Sometimes the difference between success and failure when delivering a presentation is not the presentation slides at all. The problem most often is the presenter’s delivery. In the video below, Sharon Merrill Executive Vice President & Partner David Calusdian provides tips on how to get the most out of your presentation delivery.

Read More

Investor Presentation,

IR Program Planning,

Investor Relations Agency,

Presentation Training,

Media Relations,

IPO,

Investor Relations,

Investor Relations Firm

By David Calusdian, Executive Vice President & Partner

We’ve all seen bad investor presentations at various conferences. But what makes them bad? The purpose of an investor presentation is to convey the company’s investment thesis. If the presentation does not succeed in articulating the investment thesis in a memorable way, it has failed. So how do we ensure good presentation slides — and success? In the video below, Executive Vice President & Partner David Calusdian offers up some advice.

Read More

Investor Presentation,

IR Program Planning,

Strategic Messaging,

Investor Relations Agency,

Investor Meetings,

Presentation Training,

Shareholder Communications,

Investor Relations,

Investor Relations Firm