By Sharon Merrill Associates

Our Blog: The Podium

Awards, Sharon Merrill Associates, Investor Relations Agency, Investor Relations

Sharon Merrill Associates President and Partner Maureen Wolff was selected as one of five new National Investor Relations Institute (NIRI) Fellows. NIRI Fellows are recognized leaders who represent the ideals of the investor relations (IR) profession, and have distinguished themselves on the basis of their integrity, leadership, involvement and contributions to the IR profession throughout their careers.

Sharon Merrill, Chairman and CEO of Sharon Merrill Associates said, “Maureen is extremely well deserving of this great honor by the National Investor Relations Institute. She has been a leader in the advancement of the investor relations profession for the past 30 years and an ardent supporter of NIRI. Congratulations to Maureen and the 2014 class of NIRI Fellows.”

In the NIRI announcement of the Fellows Class of 2014 , NIRI CEO Jeff Morgan said, “I am delighted to honor these five outstanding individuals who have been so important to the development of the profession and to NIRI’s success. NIRI Fellows are nominated by their peers, and represent the highest standards in the investor relations profession and in our community. We look forward to honoring them at the 2014 NIRI Annual Conference this June.”

Awards, Sharon Merrill Associates, Investor Relations Agency, Crisis Communications, NIRI, Shareholder Communications, Investor Relations, Investor Relations Firm, Activist Investors

The Sharon Merrill Associates team is excited and proud to share our own unique connection to the 2014 Sochi Winter Olympics. Julia Marino, daughter of agency CEO and founder Sharon Merrill, will be competing for a medal in the Women’s Slopestyle Skiing competition. Julia is representing her birth country, the Republic of Paraguay, as the first athlete ever to represent the South American country at the Winter Olympics. A student at the University of Colorado, Julia will be proudly carrying Paraguay’s tricolor national flag during the opening ceremonies at Fisht Olympic Stadium on Friday, February 7. The 2014 games mark the first time slopestyle, a freestyle skiing event featuring a downhill obstacle course consisting of jumps and rails, is included in the Olympics. The Women’s Slopestyle Skiing event is scheduled to air on NBC at 8 p.m. ET on Tuesday, February 11. Please join us in cheering on Julia as she takes on Sochi!

To follow Julia’s Olympic journey, find her on Facebook and Twitter.

By Dennis Walsh, Vice President

The Shareholder on a Shelf is a new tradition that has become the holiday gift of choice for IROs to their executive management teams. The story of the Shareholder on a Shelf is as follows:

“Have you ever wondered how the SEC could know;

If you’re naughty or nice in making your reported revenues and margins grow;

For 79 years it’s been a big secret;

Which now can be shared, if you promise to keep it.

At reporting time the SEC sends me to you;

I sit in the shadows to watch and report on all that you do;

My job is an assignment from Ms. Mary Jo White herself;

I am her helper, a friendly scout shareholder that sits on a shelf.

Holiday, Investor Relations Blog, Reg FD, Sharon Merrill Associates, Investor Relations Agency, Guidance, IRO, Shareholder Communications, Earnings Call, Investor Relations, Earnings, Investor Relations Firm, Activist Investors

The firm received a 2013 Bell Ringer Award from The Publicity Club of New England for an investor relations program it developed for a Fortune 500 client. The program included a highly successful investor day. The Publicity Club of New England’s Bell Ringer Awards recognize and honor excellence and achievement in the communications and public relations professions. In the past 17 years, the firm has won an award for investor relations in each of the 14 years it has entered a submission.

IR Program Planning, Awards, Sharon Merrill Associates, Investor Relations Agency, NIRI, Investor Relations

By Maureen Wolff, President and Partner

Three years ago, on the heels of the greatest collapse U.S. financial markets have experienced in decades, in conjunction with IntelliBusiness/eventVestor, we published a study, “The Guidance Effect: Improving Valuation” (PDF 875 KB), that evaluated the impact of increased transparency on equity valuation during the turbulent first quarter of 2009.

The findings supported the thesis that issuing quantitative financial guidance contributes to improved stock performance. Given the climate of fear and uncertainty that permeated Wall Street during the study period, we hypothesized that providing guidance – and thereby increasing transparency for investors – likely had an unusually pronounced affect on stock price behavior at the time.

Disclosure, Reg FD, Sharon Merrill Associates, Guidance, Earnings Guidance, Earnings Call, Investor Relations, Earnings, Investor Relations Firm

Sharon Merrill Associates on Monday captured The Publicity Club of New England’s coveted 2012 Platinum Super Bell at its annual Bell Ringer Awards, which annually recognizes the region’s most successful communications and public relations campaigns. We won the Platinum Super Bell for our investor relations program for Gibraltar Industries, recognizing us as “best in show” among the “Gold” winners in each of the 20 communications campaign categories. In addition, the agency also received a Gold Bell Ringer Award for best Investor/Financial Relations Campaign.

IR Program Planning, Strategic Messaging, Sharon Merrill Associates, Investor Relations Agency, Investor Relations

By Dennis Walsh, Senior Consultant & Director of Social Media

Let’s face it; you can’t ignore social media any longer…even as part of your investor relations strategy. You were hoping Facebook would go the way of MySpace and Friendster, but it keeps on growing and has even made its way into our world with its initial public offering.

Talk of Twitter used to elicit laughter in the board room. Now, competitors are using it to promote their brand; hedge funds are using it to decide when to make trades; and rumors spread like wildfires over the Twittersphere. Twitter companion site StockTwits has evolved as a popular platform for traders to share investment ideas. Add to that: YouTube, Flickr, SlideShare, LinkedIn, oh my! IR pros certainly put up a good fight, but it’s time to embrace social media…it’s here to stay.

Feeling a little overwhelmed? We’d like to help you with that.

IR Program Planning, Investor Relations Blog, Reg FD, Strategic Messaging, Sharon Merrill Associates, Investor Relations Agency, IR Website, IPO, Social Media, Small-cap IR, Investor Relations, Socialize IR, Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

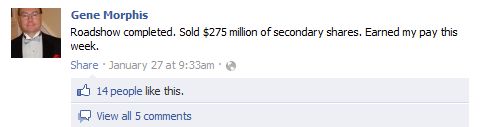

On Monday, Houston-based Francesca's Holdings Corporation (NASDAQ: FRAN) announced that it had fired its chief financial officer, Gene Morphis, after discovering he had “improperly communicated Company information through social media.” This case highlights how important it is for all companies to have a clear social media policy in place and to educate top executives on their roles and responsibilities as company spokespeople.

Mr. Morphis was very active on Twitter, publishes a personal blog, and has public profiles on LinkedIn and Facebook. Mr. Morphis spoke freely about his duties as CFO of Francesca’s in his Facebook status updates, which were open for public viewing. In one example he states that he just completed a roadshow for a secondary offering, which appears to have been announced via press release prior to the post.

IR Program Planning, Disclosure, Reg FD, Sharon Merrill Associates, Investor Relations Agency, Disclosure Policy, Social Media Policy, IRO, Social Media, Investor Relations, Socialize IR, Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

As another year comes to a close, two things are probably on every IRO’s mind: New Year’s resolutions and next year’s investor relations plan. Every year, one of the most common resolutions is to get fit. People spend a tremendous amount of time and money developing new health and fitness plans to achieve that goal. This year, apply the same techniques to your IR plan in order to have a successful 2012.

Establish Achievable Goals

You may not be ready to compete in the Arnold Classic body building competition next year, but fitting into that new bathing suit by summer is certainly a realistic goal. When developing your 2012 IR plan, set equally realistic expectations. For example, expecting to grow your capitalization from a mid-cap to a large-cap in just a few months is likely an unrealistic benchmark. Instead, focus on more achievable metrics, such as meeting with a greater number of investors, attending more conferences, or increasing trading volume. Meeting these goals will support your ultimate goal of maximizing shareholder value.

Holiday, IR Program Planning, Board Packages, Investor Relations Blog, Board Communications, Annual Meeting, Sharon Merrill Associates, Investor Relations Agency, Investor Meetings, NIRI, Investor Conference, IRO, IR Budgets, IPO, Shareholder Communications, Social Media, Small-cap IR, Investor Relations, Investor Relations Firm

-thumb.jpeg)