By David Calusdian, Executive Vice President & Partner

*Originally appeared on Samuel's CFO Blog. Samuel Dergel is Director and Search Consultant at Stanton Chase International. Mr. Dergel specializes in Executive Search for Chief Financial Officers.

As the new CFO of a publicly held company, somewhere on your extensive “to do” list is implementing an effective investor relations program. Whether or not the IR function was a well-oiled machine when you arrived, or virtually non-existent, there are key areas you need to address immediately to ensure that you are effectively taking the IR reins. So here are six steps for success as you accept responsibility for the IR function.

1) Understand your shareholder base. Research the investment styles of your shareholders to determine why they may have bought shares– and what might cause them to sell. See what type of investor concentration you have in your shareholder base. Identifying whether your shareholders are weighted toward a growth, value or income investment style, for example, can offer insight as to what they are expecting the company to achieve near or long term. Also investigate whether there are known “activist” firms among your shareholders, and what catalysts usually cause them to initiate a proxy fight. Make it a priority to speak with your shareholders by phone as soon as possible, and then meet them in person within your first few quarters as CFO. Also consider an investor perception audit to understand the sentiments of your shareholder base -- and identify any misperceptions about the company -- to most effectively build your IR program.

Read More

Disclosure,

Reg FD,

Board Communications,

Conference Calls,

Investor Relations Agency,

Investor Meetings,

Guidance,

Disclosure Policy,

Shareholder Communications,

Earnings Call,

Social Media,

Investor Relations,

Earnings,

Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

Let’s face it; you can’t ignore social media any longer…even as part of your investor relations strategy. You were hoping Facebook would go the way of MySpace and Friendster, but it keeps on growing and has even made its way into our world with its initial public offering.

Talk of Twitter used to elicit laughter in the board room. Now, competitors are using it to promote their brand; hedge funds are using it to decide when to make trades; and rumors spread like wildfires over the Twittersphere. Twitter companion site StockTwits has evolved as a popular platform for traders to share investment ideas. Add to that: YouTube, Flickr, SlideShare, LinkedIn, oh my! IR pros certainly put up a good fight, but it’s time to embrace social media…it’s here to stay.

Feeling a little overwhelmed? We’d like to help you with that.

Read More

IR Program Planning,

Investor Relations Blog,

Reg FD,

Strategic Messaging,

Sharon Merrill Associates,

Investor Relations Agency,

IR Website,

IPO,

Social Media,

Small-cap IR,

Investor Relations,

Socialize IR,

Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

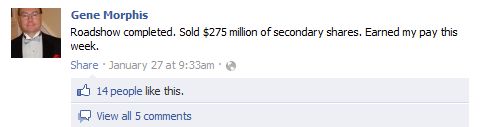

On Monday, Houston-based Francesca's Holdings Corporation (NASDAQ: FRAN) announced that it had fired its chief financial officer, Gene Morphis, after discovering he had “improperly communicated Company information through social media.” This case highlights how important it is for all companies to have a clear social media policy in place and to educate top executives on their roles and responsibilities as company spokespeople.

Mr. Morphis was very active on Twitter, publishes a personal blog, and has public profiles on LinkedIn and Facebook. Mr. Morphis spoke freely about his duties as CFO of Francesca’s in his Facebook status updates, which were open for public viewing. In one example he states that he just completed a roadshow for a secondary offering, which appears to have been announced via press release prior to the post.

Read More

IR Program Planning,

Disclosure,

Reg FD,

Sharon Merrill Associates,

Investor Relations Agency,

Disclosure Policy,

Social Media Policy,

IRO,

Social Media,

Investor Relations,

Socialize IR,

Investor Relations Firm

By Jim Buckley

To kick off the New Year, we decided to renew an old Sharon Merrill tradition and take a lighthearted look at what’s in and what’s out in investor relations and related areas in 2012. Hope you enjoy, and have a happy and successful 2012.

Read More

Hedge Fund,

Board Communications,

Annual Meeting,

Investor Relations Agency,

Proxy Access,

Crisis Communications,

Social Media,

Investor Relations,

Activist Investors

By Dennis Walsh, Senior Consultant & Director of Social Media

As another year comes to a close, two things are probably on every IRO’s mind: New Year’s resolutions and next year’s investor relations plan. Every year, one of the most common resolutions is to get fit. People spend a tremendous amount of time and money developing new health and fitness plans to achieve that goal. This year, apply the same techniques to your IR plan in order to have a successful 2012.

Establish Achievable Goals

You may not be ready to compete in the Arnold Classic body building competition next year, but fitting into that new bathing suit by summer is certainly a realistic goal. When developing your 2012 IR plan, set equally realistic expectations. For example, expecting to grow your capitalization from a mid-cap to a large-cap in just a few months is likely an unrealistic benchmark. Instead, focus on more achievable metrics, such as meeting with a greater number of investors, attending more conferences, or increasing trading volume. Meeting these goals will support your ultimate goal of maximizing shareholder value.

Read More

Holiday,

IR Program Planning,

Board Packages,

Investor Relations Blog,

Board Communications,

Annual Meeting,

Sharon Merrill Associates,

Investor Relations Agency,

Investor Meetings,

NIRI,

Investor Conference,

IRO,

IR Budgets,

IPO,

Shareholder Communications,

Social Media,

Small-cap IR,

Investor Relations,

Investor Relations Firm

By Dennis Walsh, Senior Consultant & Director of Social Media

In many of the StreetScope® perception audits we conduct, we often inquire about what makes a successful investor relations program. Is the Street satisfied with the level of outreach? Is there something specifically a firm can do to enhance its communications? Being the investor relations enthusiast that I am, I’m always hoping to discover an innovative idea that we have yet to implement.

However, more often than not, the responses are all pretty simple. Wall Street wants access to management. They want informative answers to their questions. Many even want an investor day that describes the company’s long-term growth strategy. So old-fashioned (I jest)! What about having an active Twitter/StockTwits account (follow me) or Facebook page, a cool management video or an interactive annual report?

Read More

IR Program Planning,

Corporate Access,

IR Website,

IRO,

Shareholder Communications,

Social Media,

Investor Relations

“View from the C-Suite: What Management Wants from Investor Relations” was the theme for NIRI Boston’s April event. For a chance to listen to a panel of C-level executives speak candidly to a room full of investor relations professionals, I quickly reserved a car and “zipped” over to the meeting. The panel featured three esteemed executives from the region, including Richard F. Pops, Chairman, President & Chief Executive Officer, Alkermes; David D.R. Hargreaves, Chief Operating Officer, Hasbro and Donald Muir, Chief Financial Officer, Lionbridge.

The audience was eager to hear what these top executives expect from a strong IR team. The panel consistently reinforced that IR professionals are most effective when they are knowledgeable, well organized, involved in strategic planning, and are able to stand up to management to ensure best practice.

Read More

IR Program Planning,

Board Packages,

Corporate Access,

Board Communications,

Investor Meetings,

NIRI,

Disclosure Policy,

Shareholder Communications,

Social Media,

Investor Relations,

Earnings

There is a popular cable network TV show called Bridezillas that often depicts women planning their wedding day as high-strung, unreasonable and at times displaying jaw-dropping outrageous behavior. Of course, this makes for great reality TV, but at times I find myself sympathizing with these women. After all, it will be the biggest day of their lives – it had better go as planned!

Similarly, the quarterly earnings call is one of the biggest days in the career of investor relations professionals and their companies. A seamless call is an IRO’s opportunity to shine. A call riddled with issues will damage his or her credibility. These calls require weeks of careful planning to ensure that the right messages are communicated effectively to shareholders. However, much like the bridezillas have to rely on other people to design a dress, coordinate the flower arrangements, bake the cake, etc., IROs must work with a variety of outside providers for the services necessary to facilitate an earnings call. With so much riding on the line, there is no shame in taking on the IRO-zilla role and demanding, rather, clearly stating needs and expectations. The IRO’s professional reputation is at stake.

Read More

IR Vendors,

IR Program Planning,

Investor Relations Agency,

IR Website,

NIRI,

IRO,

IR Budgets,

Earnings Call,

Social Media,

Investor Relations,

Earnings,

Investor Relations Firm

“But social media for investor relations won’t work for my company!”

The use of social media is radically changing the way our society communicates – and the investment community is no exception. But many investor relations officers still refuse to use social media as an IR tool. I’ve heard any number of reasons why “social media for IR won’t work for my company.” Our business model is primarily B2B. The retail shareholder base is small. Our market cap is less than $500 million. My corporate counsel tends to be conservative regarding disclosure. Notwithstanding the huge volume of research that supports the use of social media in IR, I think it would be easier to land a lunch with Warren Buffett than to convince the typical IRO to set up a Twitter account.

I recently spent a whirlwind of a week focused on social media in investor relations. The NIRI Westchester Connecticut chapter invited me to serve on a panel discussion entitled, “Investor Relations and Twitter – To Do or Not to Do?” with Darrell Heaps, president & CEO at Q4 Websystems (@darrellheaps), Dan Dykens, co-president at Meet the Street (@meetthestreet), and Doug Chia, senior counsel & assistant corporate secretary at Johnson & Johnson (@dougchia). I was pleased to see that more than half the room had at least been on Twitter. Two questions seemed to preoccupy the audience: “what should we know about using Twitter,” and “how can we use it as part of an effective IR strategy?”

Read More

Disclosure,

Strategic Messaging,

IR Website,

Crisis Communications,

NIRI,

Disclosure Policy,

Twitter,

IRO,

Media Relations,

Speaking Engagements,

Shareholder Communications,

Social Media,

Investor Relations,

Monitoring,

Investor Relations Firm

I recently had the opportunity to speak with Chris Lahiji, Founder and President of LD MICRO, a by-invitation only newsletter firm that focuses on finding undervalued companies in the micro-cap space and providing research for its clients. Since 2002, the firm has published an annual list of recommended stocks as well as comprehensive reports on select names throughout the year. We touched on a variety of topics from corporate access, annual reports and even the future of sell-side coverage. Chris’ unfiltered views on these subjects are refreshing and insightful for any investor relations practitioner.

Read More

Corporate Access,

Interviews,

Annual Report,

Sell-side Coverage,

Investor Conference,

Social Media,

Small-cap IR,

Investor Relations